Learn how to create a budget that works best for your lifestyle to take charge of your finances. In four rather easy steps, we’ve outlined exactly what you need to do to construct your model budget.

Step 1: Know Your Net Income and Average Expenses

You must understand your numbers before you can create an effective budget. Since most bills are due once a month, we usually choose to stick to a monthly budget.

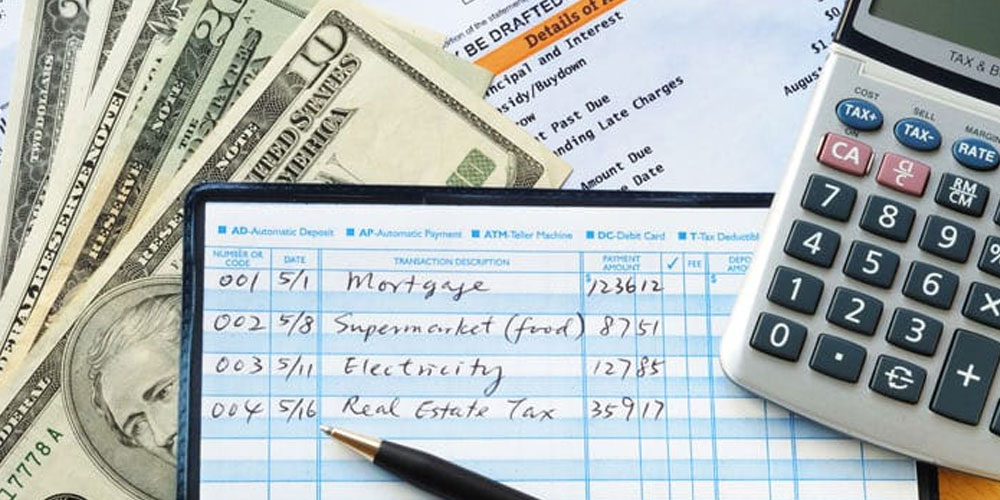

Start by getting your last few months’ worth of bank statements and entering them into your checking account online. Get your credit card statements while you’re at it.

How to Calculate Your Monthly Salary

First, write down your monthly income.

Your monthly take-home pay, or after-tax income, should be this amount. Your gross income is the amount of money you make after taxes, Medicare, Social Security, health insurance contributions, and contributions to retirement funds like your 401(k) are subtracted.

If you have a full-time, paid job, this part is simple. Use the average of the previous six months to generate a ballpark estimate if you are paid on a commission basis, work on an hourly basis, or have sporadic income (such as freelancing). Budgeters who work for themselves can gain from stepping back every three months to look at their earnings.

According to Robin Hartill, a Certified Financial Planner and former senior editor and writer for The Penny Hoarder, “you’re usually required to make quarterly estimated tax payments when you’re self-employed or have significant freelance income.” “Your budget may benefit greatly from having to check in four times a year.”

According to Hartill, you can also pay your anticipated taxes more frequently if doing so improves your ability to manage your self-employment income.

Budgeting for taxes can be much easier if payments are made weekly or monthly rather than four times a year, she said.

However, while figuring up your monthly revenue, don’t stop there. Include any additional income you receive from side gigs, child support, regular bonuses or stipends, and financial aid payments.

How to Figure Your Monthly Expenses

Your next step is the Hard part: Log your monthly expenses to see how much you spend.

Start with regular fixed expenses, which may include:

- rent or mortgage payment

- utilities

- car payment

- car insurance

- life insurance premiums

- credit card payments

- student loan payments

- other debt repayment

- cell phone bill

- internet

- cable TV

- other monthly subscriptions, like Netflix or Spotify.

Include non-monthly but recurring expenses, such as:

- vehicle registration fees

- credit card fees

- HOA fees

- professional association dues

- annual subscription renewals

To figure out how much these recurring but non-monthly costs cost each month, divide the total cost for a year by 12 before adding them to your monthly budget.

By using sinking funds, you can accumulate money for these yearly costs and be ready to cover the entire amount when the bill is due. To avoid being tempted to spend the money, you might even wish to open a different bank account specifically for those costs.

Next, begin to tally up your variable costs. Examine your purchasing patterns. How much do you spend on essentials and unforeseen, non-fixed costs like groceries, clothes, and medical bills? How much do you spend on unnecessary things like going out to eat and drinking with friends?

Sort your expenditures into budget categories to obtain a complete picture. For instance, entertainment can include things like movies, concerts, and museum trips. The drop-in rate for a CrossFit class, your yoga membership, and your gym membership can all be classified as fitness.

Look at a few months of statements to get an average for this part, too. That will give you a more accurate picture of your finances.

Step 2: Set Financial Goals

You must know what you want to achieve if you want to be successful at this budgeting game. Your budget should be in line with your objectives.

It could be a straightforward short-term savings objective, such as saving for a trip with your college pals or creating a little emergency fund. Or it may be something more long-term, like sending your child to college without taking out student loans or learning how to budget so you can pay off your mortgage early. No matter how distant you are from reaching that goal, don’t forget to fund your retirement.

Your financial plan may be the only thing preventing you from using your credit cards for thoughtless shopping. Therefore, set a goal and make it a motivational one.

Next, rearrange your priorities. To get a sense of where you want your money going, write them down in order of importance.

It’s acceptable if you don’t first prioritise your tasks correctly. Selecting one option over another is difficult, and you may always modify the original list if it doesn’t work. Strike a balance between “fun” and “responsible” spending by making some adjustments.

Combining your personal and financial objectives will help you go further. For instance, committing to cook more at home can enable you to keep to healthy eating habits and spend less on eating out. You may save money at the grocery store by making a shopping list and planning your meals.

Step 3: Find Your Favourite Budgeting Method

It’s time to choose the budgeting strategy that suits you best after you have a comprehensive understanding of your financial situation. There are numerous approaches to budgeting from which to select.

Spreadsheet Budget

Use a Google Sheets or Microsoft Excel spreadsheet to keep track of your expenses and record your income. For data visualisation, make pie charts, line graphs, and bar graphs.

Zero-Based Budgeting

When you create a zero-based budget, you specify each month where each dollar of your income will go. You should have nothing left over after deducting all of your scheduled expenses, savings, and debt payments from your income.

Cash Envelope System

Cash envelope system: Catholics stuff envelopes with cash by their spending caps for all of their variable costs, such as entertainment or groceries. You must stop spending until the end of the month or whenever it’s time to refill your envelopes once they are empty.

50/30/20 Method

The 50/30/20 budget plan allocates 50% of your income to necessities, 30% to leisure, and 20% to financial objectives such as debt repayment, investing, or saving. As long as you keep within the proper percentages, you don’t need to get too specific about how much you should spend on takeaway or transportation.

Bare-Bones Budget

Only the necessities are considered in a bare-bones budget. It is appropriate for persons with limited incomes or those attempting to trim unnecessary expenses from their budget in order to accumulate funds for debt repayment, emergency savings, or other savings.

Calendar Budget

The calendar budget method involves writing down when you get paid, when your payments are due, and when you spend money on a real calendar. At the conclusion of each day, write down how much money you still have.

Half-Payment Method

Paying monthly recurring expenses can be less stressful when you use the half-payment technique. To lessen the financial strain when the bills are due, you budget for half of your typical home expenses one month in advance.

Paycheck Budget

The pay cheque budget disregards the standard guidelines for making a budget that will cover your monthly expenses. Rather, you set aside money for each payment period, be it weekly, bimonthly, or semi-monthly.

You should feel free to modify your preferred budgeting technique to suit your financial circumstances, even after you have chosen it. You may decide to include elements of other budgeting techniques in your budget. Discover how Kumiko Love of The Budget Mom developed her budget-by-paycheck system by combining three different budgeting approaches.

Step 4: Find the Best Budgeting Tools for You

You’re not alone in this quest to budget your money. Some tools and actions can help.

Automate Your Budget

By directing the funds to the appropriate location before you have the opportunity to spend them carelessly, automating the budgeting process helps you concentrate on your goals.

Regarding income, this may entail establishing an automatic transfer from your pay cheque to your savings and bank accounts.

To help you avoid those dreaded late fees, you may set up autopay in the costs column for monthly expenses like your credit card bills, student loans, and auto payments. Additionally, you can call a lender or business and request that they change the date if your bill due dates conflict with your cash flow.

To grow your emergency fund, you can have a portion of your direct deposit go into a savings account each time you get paid.

Budgeting Apps

Budgeting by hand is fantastic, but it can be made more efficient with your smartphone. Money management is made easier with budgeting apps like Cleo and Rocket Money, which also double as real-time spending tracking tools.

Numerous programs automatically classify your spending, sync with your checking account, and provide you with a quick overview of how much you can afford to spend before your next pay cheque. Some may even use your historical spending patterns to create a budget for you.

You have to manually enter your spending in other apps. Without requiring you to examine months’ worth of bank statements, that procedure can give you information about your spending patterns and point out areas where you might cut costs.

Picking your favourite budgeting app is made easier with this list of our top picks. Here are our suggestions for the top budgeting apps for couples if you and your spouse are handling home finances together.

You can start with a free trial to evaluate if it’s worth the money, even if some apps have monthly or yearly costs.

Don’t Allow Failures to Depress You

Don’t feel bad if your initial budgeting attempt fails.

It’s normal to overlook certain costs or establish overly stringent expenditure caps the first time. Simply persevere and make changes as needed.

One of two things could cause you to go over your budget: either you set unattainable goals for yourself and don’t reach them, or you neglect to stick to your budget and quit up.

To make your money plan feel less constrictive, make sure to allow for some enjoyable expenses. It can be necessary to find an accountability partner, a buddy with whom you can discuss your financial objectives and who will encourage you to continue being consistent and to act when you stray.

Keep in mind that creating a budget is a continuous process. As your objectives and life evolve, stay focused on your plan. Every life transition, including increasing your salary, leaving your job, getting married, having children, and launching a business, necessitates reviewing and adjusting your budget in order to stay on track, achieve your objectives, and enjoy life.